1095 Forms: 1095-a vs. 1095-b vs. 1095-c

Employers may become overwhelmed by health insurance paperwork and reporting responsibilities. Under the Affordable Care Act (ACA), the IRS requires all applicable employers and qualified health plan providers to report information about their health plans and health coverage enrollment using tax Forms 1095 A, B, and C. However, there are different requirements for each of these documents.

Description Form 1095-B The Internal Revenue Code (IRC) Section 6055 outlines the requirements for 1095-B reporting. Form 1095-B must be issued by the

B1095B05 - Form 1095-B - Health Coverage

Shop - Paper Products - 1095 Forms - Page 1

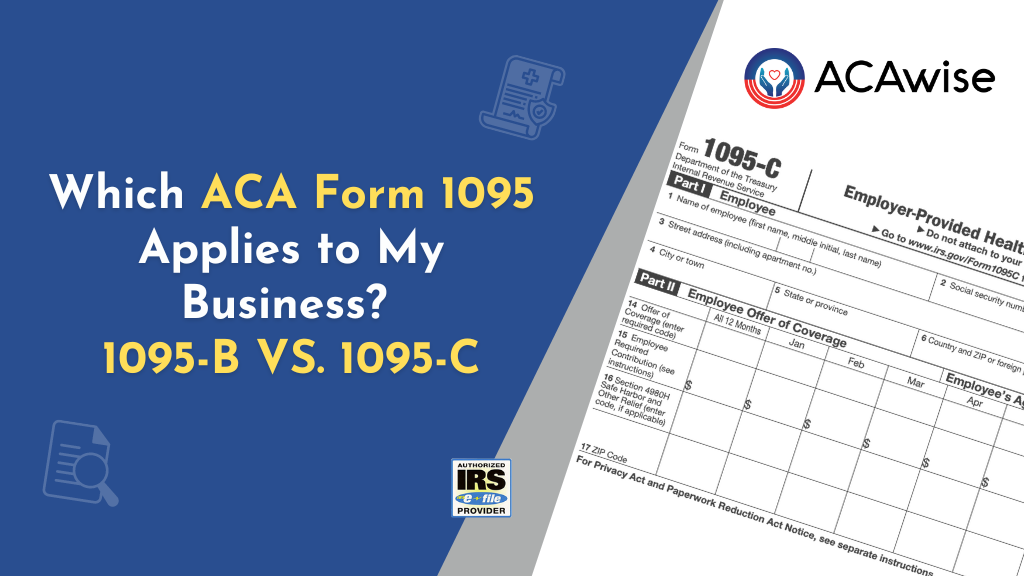

Employer Shared Responsibility (ESR) Reporting Requirements

Which ACA Form 1095 Applies to My Business? 1095-B VS. 1095-C

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

Form 1095-A: Definition, Filing Requirements, How to Get One

Difference Between Gross vs. Net Income and Pay

How HR Can Help Shape Organizational Strategy

Difference Between Gross vs. Net Income and Pay

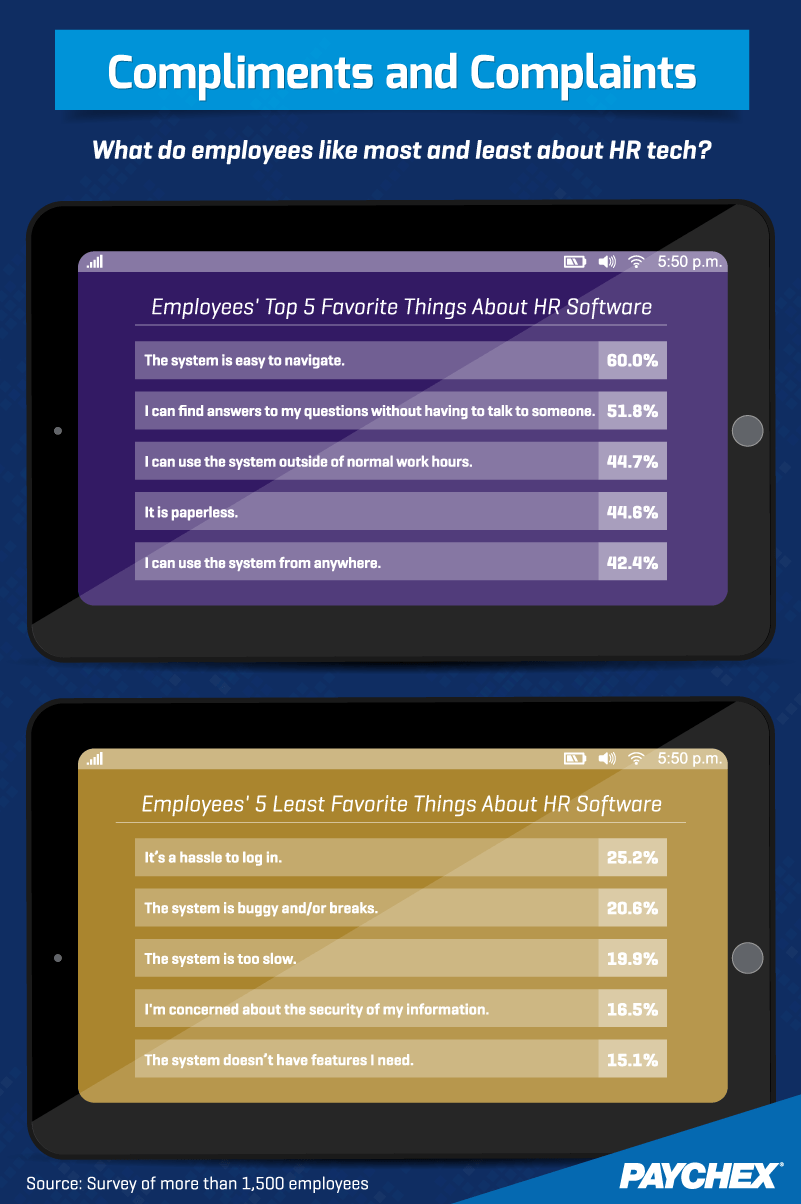

There's an App for That: HR Goes High-Tech

Form 1095-C Instructions - Office of the Comptroller

What are the Differences Between Form 1095-A, 1095-B, and 1095-C?

Florida Mandates Use of E-Verify for Private Employers with 25 or More Employees