A Note On KappAhl AB (publ)'s (STO:KAHL) ROE and Debt To Equity

Many investors are still learning about the various metrics that can be useful when analysing a stock. This article is

Chapter 17 Capital Structure Determination. Copyright 2001

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

Current Stock Deal Settings - CFD - Retail, PDF

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

A Note On KappAhl AB (publ)'s (STO:KAHL) ROE and Debt To Equity

KAPPA KAPPA GAMMA (@calpolykkg) • Instagram photos and videos

Cap Table Management for LLCs

Solved Surj Uppal and Parvinder Atwal began a new business

A Note On KappAhl AB (publ)'s (STO:KAHL) ROE and Debt To Equity

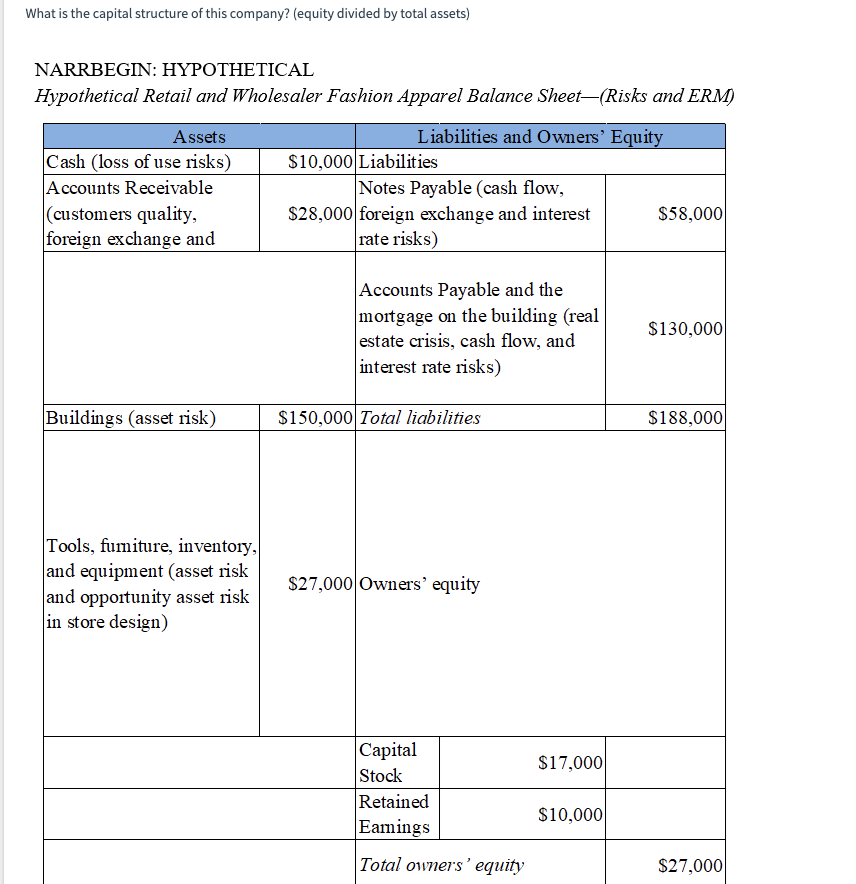

Solved What is the capital structure of this company?

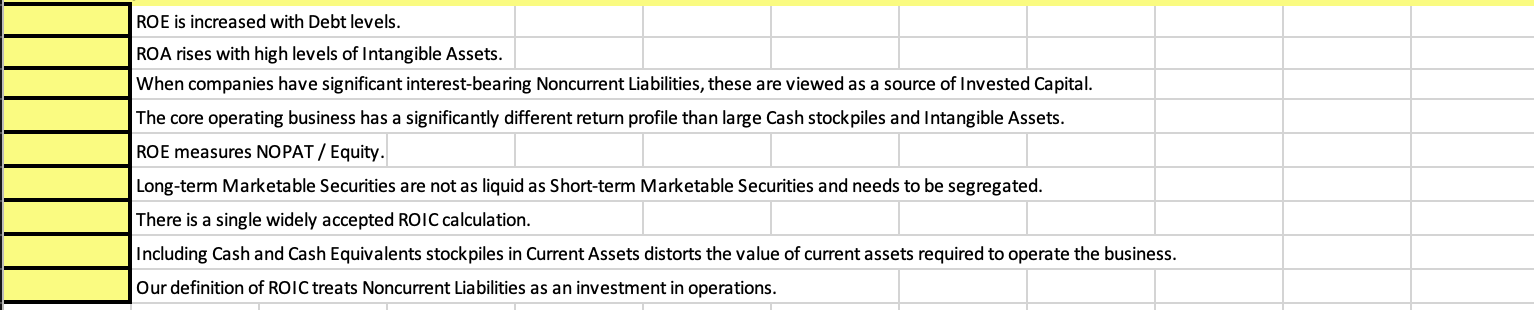

Solved ROE is increased with Debt levels. ROA rises with

:max_bytes(150000):strip_icc()/GettyImages-175599141-945d5edd9a33454cb4a100e9e4bd8c74.jpg)

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

Solved What is the capital structure of this company?

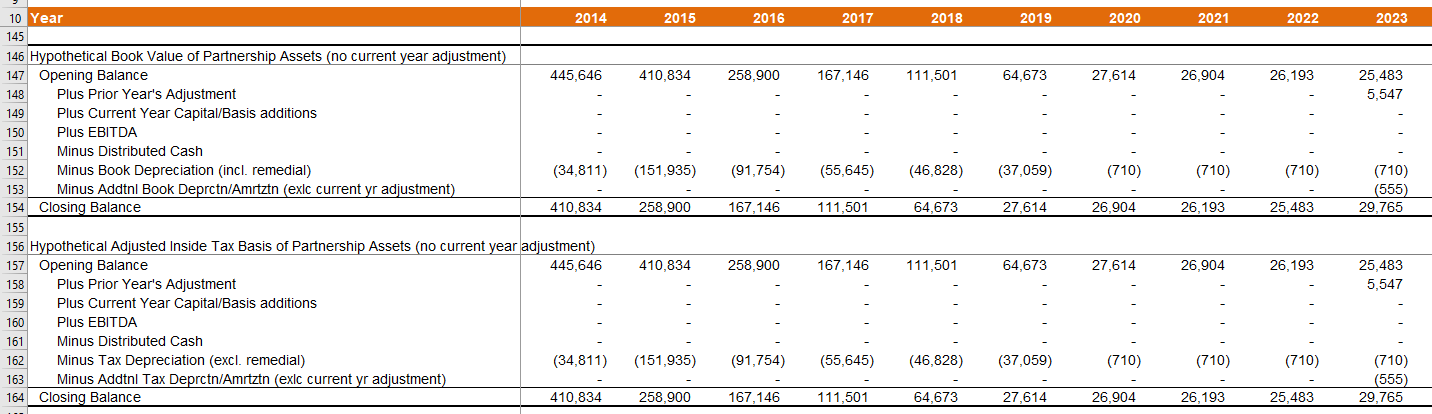

Tax Equity Structures in U.S. – DRO's, Stop Loss, Outside Capital