Business Under GST – Overview, Meaning and Examples - Enterslice

It will amount to be a business under GST Act no matter if it was a one-time transaction or a regular one term in furtherance of the business.

Enterslice is the Asia's Top 100 Award Winning CA/CPA and Legal Technology Company

Double Taxation Avoidance Agreement: What is DTAA, Benefits & Rates

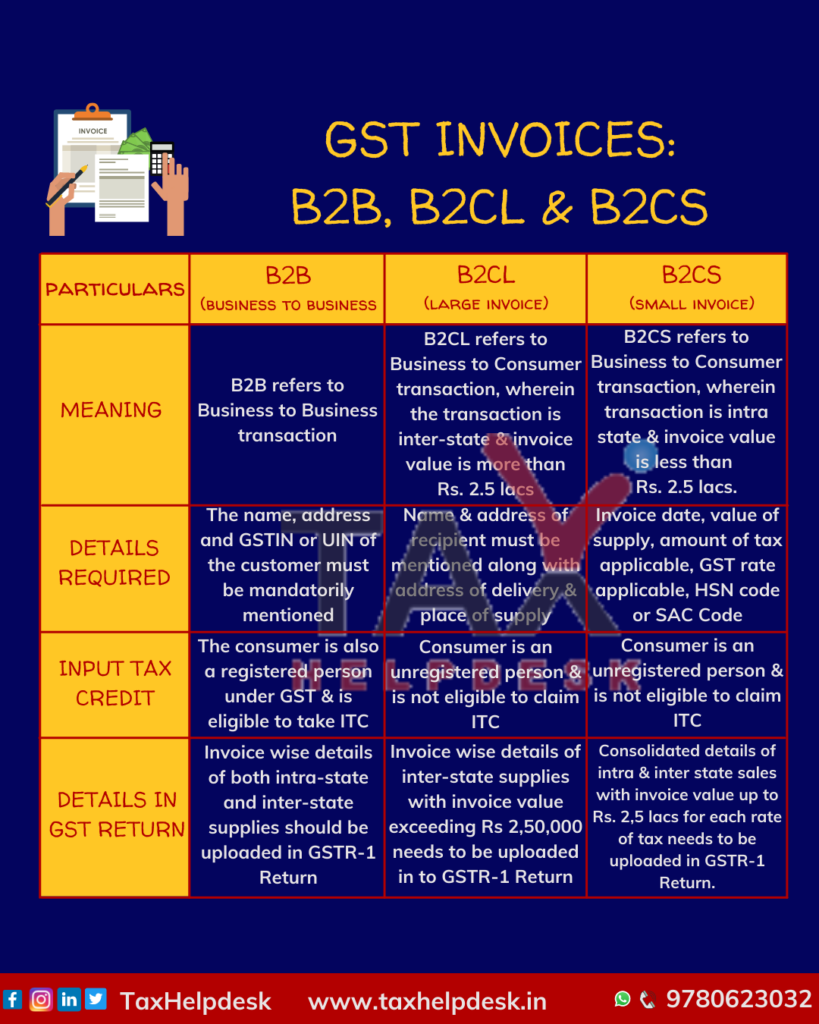

GST Invoices: B2B, B2CL and B2CS

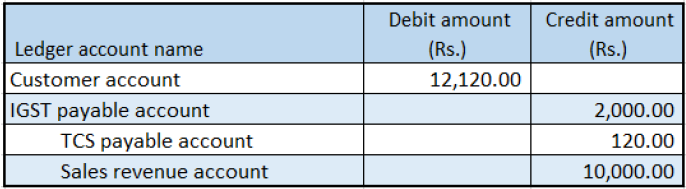

Include GST when calculating tax collections - Finance, Dynamics 365

Is Your New Idea Patentable? Let's Figure it out! - Enterslice

Introduction To Gst And Its Implications - FasterCapital

GST Basics: A Complete Guide - QuickBooks

Introduction to Gst, Goods and Services Tax, Taxation, What is G.S.T

PPT - One-Person Company Registration: What You Need to Know PowerPoint Presentation - ID:12771024

What Is GST Invoice? Rules, Format and Types in 2024

GST vs. Income Tax - What's The Difference (With Table)

Enterslice (u/enterslices) - Reddit

All Categories

Procedure for Sole Proprietorship Registration in India Sole proprietorship, Registration, Online registration

Business Under GST – Overview, Meaning and Examples