Solution to VAT Requirements for Non-UK Resident Companies - Seller

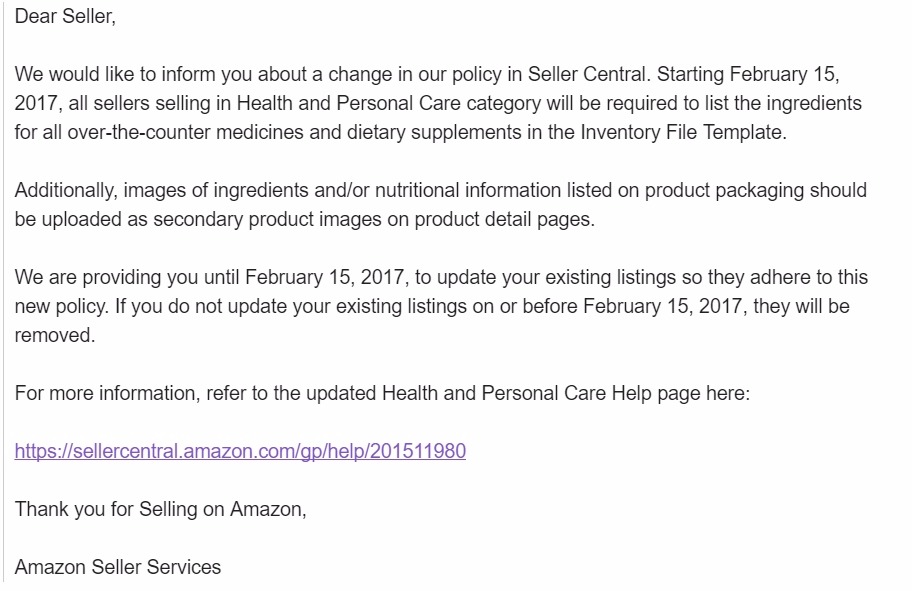

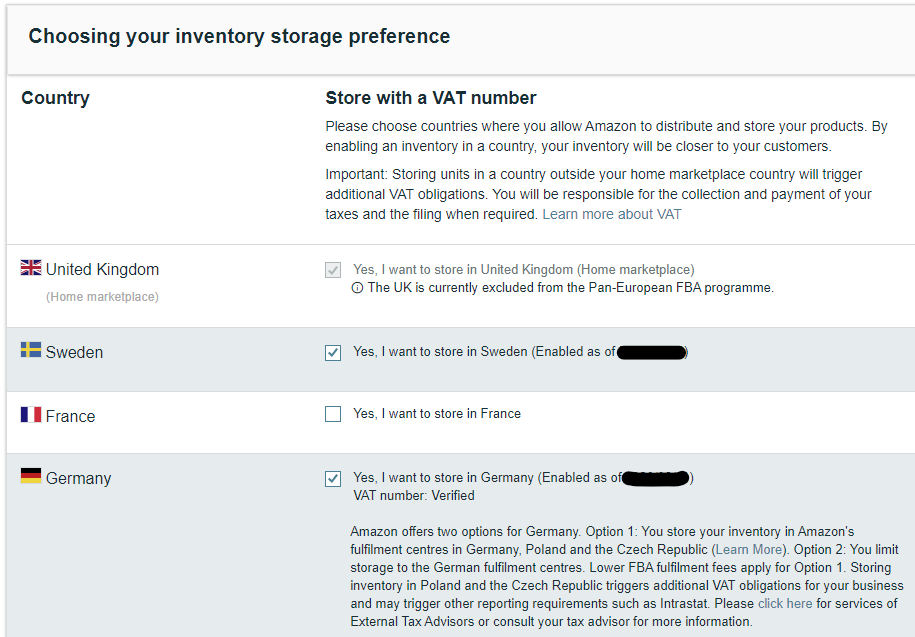

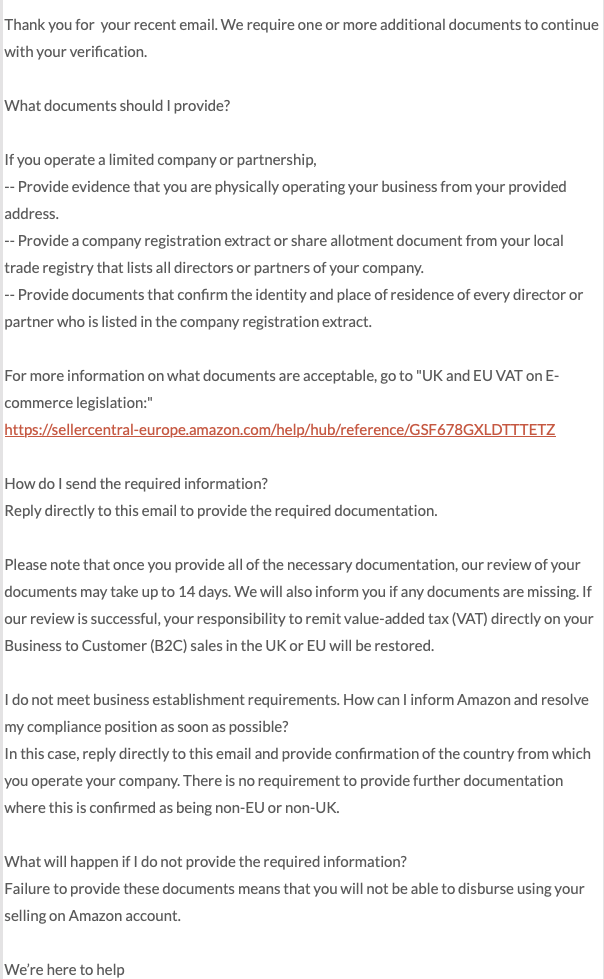

Introduction: In recent times, non-UK resident companies selling on have encountered a new challenge in the form of VAT requirements. is now asking these businesses to pay 20% VAT, regardless of whether they have crossed the sales threshold of £85,000.

Dropshipping & VAT : examples, exemptions, & more

The Ultimate VAT Guide for Sellers in UK & Europe

The Ultimate Guide to VAT (For US, UK, EU Sellers) - A2X

Amazing VAT mail I got from . I am very worried.

Disbursements deactivated - Non-UK Resident VAT

VAT Registration in the UK

What is EU value-added tax (VAT) & VAT OSS?

VAT when running a business Low Incomes Tax Reform Group

upload.wikimedia.org/wikipedia/commons/thumb/5/5d/

VAT – what you should know when selling online

If you are VAT registered and not yet in Making Tax Digital you need to act now

Guidelines for payment for services in the UK or overseas

VAT Registration Slovakia - 2024 Guide

UK Taxes for Ecommerce: 2024 Guide for Online Sales - ShipBob UK